2020 Housing market trends

by Joe Gomez posted on February 7th, 2020

Low mortgage rates, tight supply, and softening home prices: what does it all mean if you’re buying a home, selling, or just sitting tight? We created this guide to help anyone who isn’t an expert or a psychic understand today’s housing market trends.

Chapters

- 1.

- 2.

- 3.

See what we can offer on your home

Get an offerThe path to 2020

It’s still the longest period of economic growth in US history.

2019 was a relatively upbeat year for the economy. While many expected a recession, typically defined as two consecutive quarters where the economy shrinks instead of expands, we saw a slow, but steady increase in jobs and Gross Domestic Product (GDP) throughout the year.

Why does that matter? When the economy is expanding, more people have jobs, higher wages, and thus, more money to spend on things like houses. Here’s a snapshot of these trends, which make up the “pillars” of a growing economy.

The increases in employment, wages, and consumer spending are good news for the housing market as we enter 2020, but we can’t expect to see growth forever.

The Fed lowered interest rates 3 times in 2019

The Federal Reserve, or “Fed” for short, wants to maximize employment and stabilize prices, all while keeping the US economy growing at a steady pace. One of the ways it does this is by controlling the Federal Funds rate.

The Federal Funds rate directly influences short-term interest rates, like the interest you’d pay on a credit card or a 1-3 year personal loan. When interest rates rise, people spend less and save more which slows inflation.

In 2019, inflation was stubbornly lower than what the Fed had targeted, so it lowered the Fed Funds rate to encourage more spending and investment.

Why did the Fed lower rates in 2019? Uncertain trade policy and slowing global growth.

While the US economy showed signs of growth in 2019, other major economies around the world began to slow down. This combined withescalating tensions between the US and its trade partners, caused many US companies to pull-back on spending and investment.

In response, the Fed lowered the federal funds rate three times and took other measures similar to quantitative easing to make it easier for businesses to borrow money and create jobs. This helped expand the economy despite major headwinds.

So what do lower rates have to do with housing? Lower interest rates make it cheaper to borrow money, making home ownership more affordable and allowing more people to qualify for a mortgage.

See our blog on interest rates and home ownership to learn more. The good news is mortgage rates have continued to stay historically low between 3.5% – 4.5% this past year, according to Freddie Mac.

Lower mortgage rates allow you to purchase a home with a lower monthly payment.

A 1% decrease in mortgage rates means you could pay 10% less per month.

Here’s an example:

| Purchase Price | $250,000 |

| Monthly payment with 4% interest rate | $1,431 |

| Monthly payment with 3% interest rate | $1,297 |

| $ Savings | $134 |

| % Savings | 9.4 % |

Source: Opendoor mortgage calculator; Assumes 30-year, fixed-rate mortgage; 20% down; $75 for insurance; and $210 for property tax.

→ See more real estate tools for planning your move.

Housing affordability improved in 2019, but buyers still don’t have many options

Over the past five years, there has been rapid growth in home prices while the number of homes for sale has continued to decline.

Here’s some of the reasons why:

- Low interest rates and a growing economy are enabling more people to buy a home, increasing demand.

- Home building has been slow to recover from the 2008 recession, leading to a housing shortage.

- A lot of people are staying put either to recover equity in their home or to take advantage of low mortgage rates by refinancing their loan.

Increasing demand for homes and fewer homes for sale has caused prices to rise beyond what many people can afford. However, that trend finally started to reverse this past year.

We can measure housing affordability on a scale from 0 (most affordable) to 10 (least affordable) using the John Burns Affordability Index.

At the beginning of last year, the US housing market reached a 7/10, meaning it was expensive for the average buyer. But, over 2019, the market returned to its average level of affordability.

That’s good news for buyers looking for a better deal and for sellers who want to see more buyers enter the market.

Despite more affordable conditions, low supply (the number of homes for sale) continues to be a major challenge for the housing market today. Senior economist George Ratiu said it well when he told CNBC:

2020 will prove to be the most challenging year for buyers, not because of what they can afford but rather what they can’t find.

With fewer options in 2020, a lot of buyers may delay a home purchase at a time when they could afford a home simply because it’s harder to find “the one”.

The good news is there are new ways to buy, sell, or trade-in a home that make navigating these conditions a lot easier.

→ Planning a move? Start with Opendoor.

The 2020 housing market

Is 2020 a good time to buy or sell a home? Here’s what to expect

2020 in a nutshell:

In 2020, low interest rates and softening home prices are creating more affordable opportunities for buyers who are migrating from expensive urban markets to suburban areas of mid-size cities like Phoenix, Dallas, Atlanta, and Raleigh. However, supply is still low, especially for “starter homes” at lower price tiers, which means sellers can demand a premium in many markets.

Due to low supply, first-time buyers face less affordable conditions, but home building is expected to grow at the fastest rate in over a decade. However, it may take a while for this new inventory to provide some relief. The bidding wars are likely to continue in markets with good jobs, good weather, and access to urban centers.

Or as Ralph McLaughlin, deputy chief economist and executive of Research and Insights at CoreLogic, told RIS media:

The housing market is in the midst of a normalization period, one that is characterized by slowing price growth, moderate sales, and new supply that is slow to market.

We’ll dive into each of these trends below with more detail. Here’s what to expect whether you’re buying, selling, or sitting tight in 2020.

Many economists agree a 2008 repeat in 2020 is very unlikely

While the positive trends in unemployment and economic growth over the past year can always reverse, many of the symptoms that led to the major housing market crash in 2008 aren’t present today.

Here’s a brief recap of the housing crash in 2008:

The Subprime mortgage crisis led to a record decline in home values, about 30 percent from the peak (that’s a lot). Risky lending practices encouraged people to take on more housing debt than they could afford. This led to a record number of foreclosures as many homeowners failed to keep up with monthly payments.

As more people began to foreclose on their homes, the supply of homes for sale rose dramatically while the demand to purchase homes fell causing home values to crash.

Why is 2020 different than 2008?

- We have tighter lending standards with the number of people unable to pay their mortgage at its lowest rate in over a decade.

- Households have more disposable income and less debt, bolstered by low unemployment.

- Housing supply is significantly lower than pre-crisis conditions where there was “over-building” before prices crashed in 2008.

If you’re waiting for a big crash to bring prices down, many economists believe you’re more likely to see slower or flat growth in home prices but not the major correction from a decade ago. Or as Ken Johnson, of Florida International University, told RIS media:

A weaker U.S. economy and/or a rise in rates could easily trigger a bumpy housing market. But, there’s no evidence that a slump to the magnitude of last decade’s crash is imminent, even under the worst-case scenario.

Alternatively, if a housing market crash is your primary concern for avoiding a home purchase, then it may be better to focus your search on a home you can comfortably afford rather than trying to predict the market and overextend your finances.

Homebuyer budgets appear strong – More Millennials expected to enter the market

Steady job growth and an increase in the median wage continue to fuel housing demand. Aside from rising wages, another good sign of financial health is spending less disposable income on repaying debts like credit cards, auto loans, and personal loans.

Today, household budgets continue to be the strongest they’ve been in over 40 years and a far cry from 2008, suggesting consumers have more disposable income to buy a home.

While the chart above paints a rosy picture of consumer finances, it doesn’t include student loan debt which has reached record levels and significantly affects Millennials (those born 1981-1997).

The homeownership rate among Millennials hit a record low in 2016, but it’s since picked up steam as low rates and softening home prices have led more renters to become buyers.

According to Realtor.com, 4.8 million millennials are hitting the peak home buying age this year. For the first time ever, Millennials’ share of mortgage originations is expected to surpass 50 percent, outnumbering Gen X and Babyboomers combined.

Recent census data show that Millennials are leaving big cities for cheaper housing and better schools. Or as William Frey, a demographer at the Brookings Institution, told the Wall Street Journal:

What’s different from [past migrations] is that growth is far more selective—limited to suburbs blessed by good weather and good jobs, largely in the Sunbelt, where they are growing more than twice as fast as neighboring cities.

It’s fair to assume there will be an influx of new first-time home buyers in 2020, but it may not be the boom many hope. Recent census data also show that all age-groups are moving at the lowest rate since the 1940’s with the steepest drop among younger groups.

So, where are people looking to buy homes?

These were the hottest Opendoor zip codes of 2019

→ Explore our listings or download the app to start self-touring homes.

Supply to remain tight despite an uptick in new homes built

Whether homebuyers continue to flock to up-and-coming burbs, or not, in 2020 has a lot to do with how many homes can be built. More homes built means more options, which helps to stabilize prices so more people can enter the market.

The chart below shows the running total of new household formations (aka new families that may need homes) in blue, total new homes built in orange, and in grey, are new homes built with less than 1800 sq ft, representing new “starter homes”.

The rising cost of land, labor, building materials, and regulations, are some of the reasons why we see significantly more blue (people who may need homes) than orange (total homes built) since 2008. You can also see that few of the new homes built were “starter homes” focused on first-time buyers.

The good news is the number of new single family homes being built is expected to reach over 1 million in 2020, which would be the fastest rate since 2007.

But in some ways, it’s too little, too late for this year. Lawrence Yun, Chief economist at NAR, told RIS Media:

We need a strong ramp-up in construction, but, more likely, it will be a steady increase. There will still be a housing shortage at the mid-price [tier] and lower.

→ Looking to buy a new home? Save money and stress.

Low mortgage rates and slowing home prices to provide some relief

Despite healthier wallets, home buyers are particularly sensitive to mortgage rates given the high cost of homes across the country. As of January 2020, the average cost of a 30-year, fixed-rate mortgage is 3.7%, according to Freddie Mac.

And for the rest of 2020, most lenders are anticipating the same. According to NerdWallet’s survey of national mortgage lenders, most major lenders are predicting mortgage rates to end 2020 within a quarter of a percentage point of where they are now.

That’s great news if you’re buying a home!

Buyers may also have the added benefit of slower growth in home prices compared to last year. Realtor.com, John Burns Real Estate Consulting, and the Urban Land Institute are all estimating home prices to increase an average of just 2 percent or less in 2020 compared to an average of 4 percent last year and 6 percent in 2018.

How will the 2020 Housing Market trends affect me?

All of the trends we've described will take shape differently across the country. Use the chart below to estimate the market “temperature” where you’re selling or thinking of buying. Hotter markets are characterized by lower supply, fewer days on market, and faster rising home prices. In markets with these conditions, sellers tend to have the upper hand. In cooler markets, the oppiosite is true, meaning buyers can have more options and negotiate a better deal.

Market Temperature

Regional Multiple Listing Service data through

Select metro

Warm

75/100

DOM

Average days on market

Appreciation

Median sale price

Supply

Months of supply

To calculate market temperature, we apply a series of coefficients that weigh how the market compares to the median Days on Market, median sales price, and average months of supply. The score is between 1 - 100, where <= 25 is "Cold"; <= 50 is "Cool"; <= 75 is "Warm"; <= 100 is "Hot". Hot markets tend to have faster selling homes, rising prices, and low supply. The reverse is true for cold markets.

Don’t see data for your market? Sign up for updates when Opendoor launches near you.

Anxious about the market?

Opendoor is a better way to move.

Opendoor is a full-service real estate company, and we’ve created a new way to buy, sell, or trade-in a home that emphasizes convenience and certainty.

Here’s how we can help, especially in challenging market conditions:

Certainty in uncertain conditions for sellers.

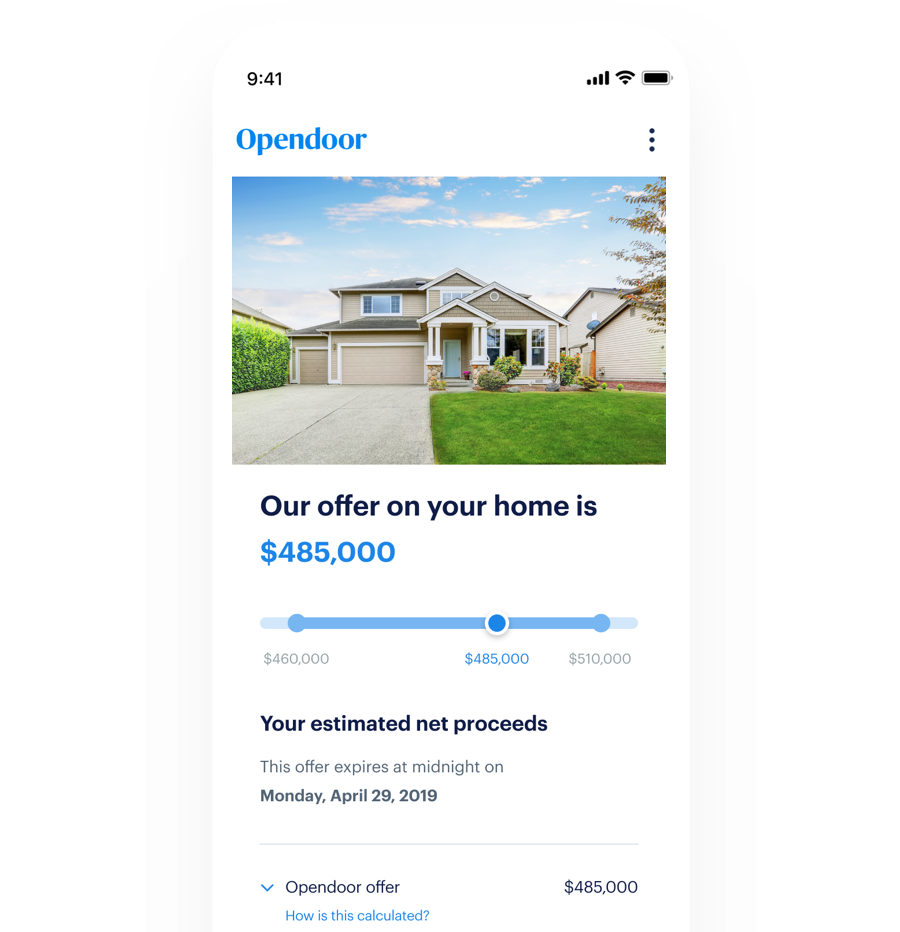

When you sell to Opendoor, you avoid the stress of listings, showings, and months of uncertainty. Answer a few questions about your home online, and we’ll make a competitive, all-cash offer within 24 hours.

If you like your offer, you’ll schedule a free in-home assessment and choose your close date, which gives you control of the timeline. Learn more about our fees and how selling to us works. Requesting an offer is free, and there’s no obligation to accept.

→ See what we can offer on your home.

More options for buyers.

When you Buy with Opendoor, you can save thousands at close and choose your level of support, whether you want to buy directly or with an agent of your choice. You’ll also have the freedom of on-demand tours and the confidence of a 90-day home buyback guarantee.

→ Learn how buying with Opendoor works.

Buy and sell at the same time.

Consider “trading in” your home so you can align your move-in and move-out dates. That way you save money and avoid the added costs of double moves and double mortgages. We also have over 50 trade-in partnerships with the top national home builders, making the process of building a home a lot easier.

Unlock an offer on your home

- Get a free, no-obligation offer in 24 hours.

- Skip the hassle of listings, showings, and repairs.

- Close on your own timeline.